If you’re a sole trader or in a partnership and your accounting period ends between April 6th and March 30th, you need to know HMRC’s latest statement!

In brief, HMRC recently released a statement to say they’re wanting to standardise the accounting periods across the country. This means offering some businesses in operation the chance to get relief if they chose to change their accounting period.

That said, we know there’ll be some question marks popping up as a result of this statement. So, we’ve answered the pressing questions surrounding HMRC’s new announcement to make sure you’re kept informed about your tax return.

What is HMRC Changing About Accounting Periods?

Right now, sole traders and partnerships typically have an accounting date of the 5th of April. This means your tax year runs from the 6th of April to the 5th of April the following year; then, you need to complete your tax return.

However, there are some sole traders and partnerships that have an independent accounting date situated between the 6th of April and the 30th of March the following year.

HMRC wants to be able to bring the accounting periods of these sole traders and partnerships in line with standardised processes. So, their accounting date would also become the 5th of April. If this affects you, you’ll want to continue reading to find the ins and outs of how your accounting period may change.

Who is Affected by the Change in Accounting Periods?

It is only sole traders and partnerships with an accounting date between the 6th of April and the 30th of March that will be affected by this change. The change won’t affect any companies; nor will it affect any sole traders or partnerships with the 5th of April as their accounting date.

How Will My 2023/24 Profits Be Assessed?

The 2023/24 tax year will be used as a transition period where you will be provided with any overlap relief you may be due.

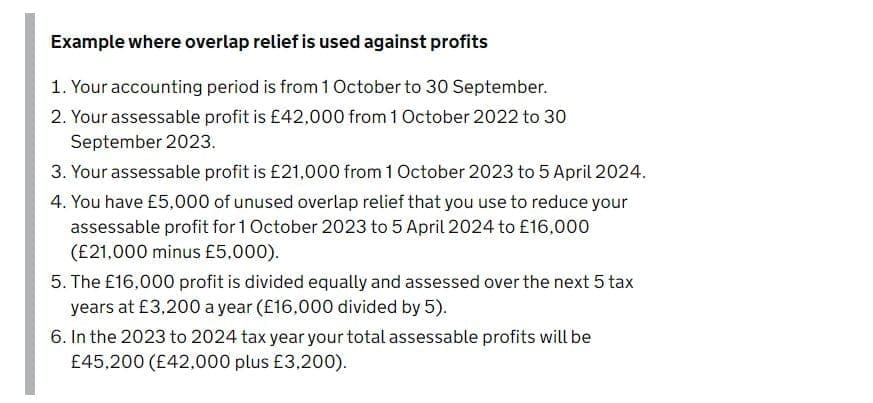

From the 6th of April, 2023, your new tax year will begin. When you file your taxes after the 5th of April, 2024, you will have a new calculation that takes into account the tax you paid in your 2022/23 tax year. If there is an overlap between these two calculations, you will be provided with overlap relief. This relief will be spread across the next 5 tax years unless you specify you would like it to be used over a shorter period.

Of course, there is a chance your profits may rise throughout the 2023/24 tax year. If this is the case, HMRC has said they will treat these profits in a specialised way to help minimise the impact on your benefits and allowances.

What is Overlap Relief?

Overlap relief is tax relief you may be entitled to if you pay tax on the same profits twice. For example, if your accounting period is the 1st of October to the 30th of September, but you change to the standardised accounting period of the 6th of April to the 5th of April, you will be paying tax on the same profits you made between the 1st of October and the 5th of April.

This is called an overlap period. To avoid you paying tax twice, HMRC will be providing you with relief for the total profit made in that period called overlap relief.

If you’re entitled to overlap relief, HMRC will be spreading the relief over the profits that you make in the next 5 years so you see the biggest benefit. However, you have the option to request your overlap relief to be provided over a shorter period.

Here’s the example HMRC gave:

Should I Move My Self-Assessment Date?

HMRC is releasing a number of statements of change at the moment. The biggest change is their “Making Tax Digital” (MTD) initiative where all individuals and companies must use cloud-based software to keep their books and submit their returns.

Because of this, it’s easiest for you to move your accounting date during this period of change. However, there’s currently no enforcement to do so, meaning you can stick to using whichever dates work best for your business.

That said, you may be aware of the current restrictions on changing your accounting date. These are being lifted for the 2023/24 tax year to aid in the process should you choose to go with it; plus, HMRC is being lenient on their allowances for overlap relief.

Another thing to have in your mind is that, if you do move your accounting date to the 5th of April, you will no longer need to divide the profits on your tax return every year.

Will My Accountant Help With Accounting Period Changes?

Yes. Your accountant isn’t just there to crunch the numbers and be an intermediary between your business and HMRC. We’re also there to provide you with up-to-date information and guidance about how’s best to use your accounting period for your business.

For example, if you do decide to change the accounting period of your business, you’ll need to fill out box 11 on the SA103F (the self-employment page) of your tax return. This is something your accountant will be able to assist with.

If you have more questions about HMRC’s statement on changing the accounting period for sole traders and partnerships then contact the team at Phillips & Co Accountants, today.

The New VAT Penalties for Late Payments

HMRC is rolling out a new VAT penalty scheme to come into effect for all submissions for accounting periods that start from 1st January 2023.

Facts About the £150 Council Tax Rebate

The Government is urging eligible households to claim their £150 council tax rebate as November 30th comes because, this time, the deadline won’t be extended!

7 Accountancy Software Packages Best for MTD

On 1st June, 2022, HMRC released an update to the rates of mileage for company car drivers. However, these changes have seen a vat of criticism.

Legal Disclaimer

The information on this website is intended for guidance only. It is based upon our understanding of current legislation and is correct at the time of publishing. No liability is accepted by TPP Accountants Ltd T/A Phillips & Co Accountants for actions taken in reliance upon the information given. Furthermore, this website contains links to external sources of information which we believe you will find useful. However, we are not responsible for the content or integrity of any external websites and, as such, accept no liability for any viruses or malware connected to those sites and any resultant damage caused. Phillips & Co Accountants.

Registered Address: 29 Marfords Avenue, Bromborough, Wirral, CH63 0JH. A list of directors is available at the registered office. Phillips & Co Accountants Chester is the trading name of TPP Accountants Ltd. Phillips & Co Accountants Copyright 2022.